where do i pay overdue excise tax in ma

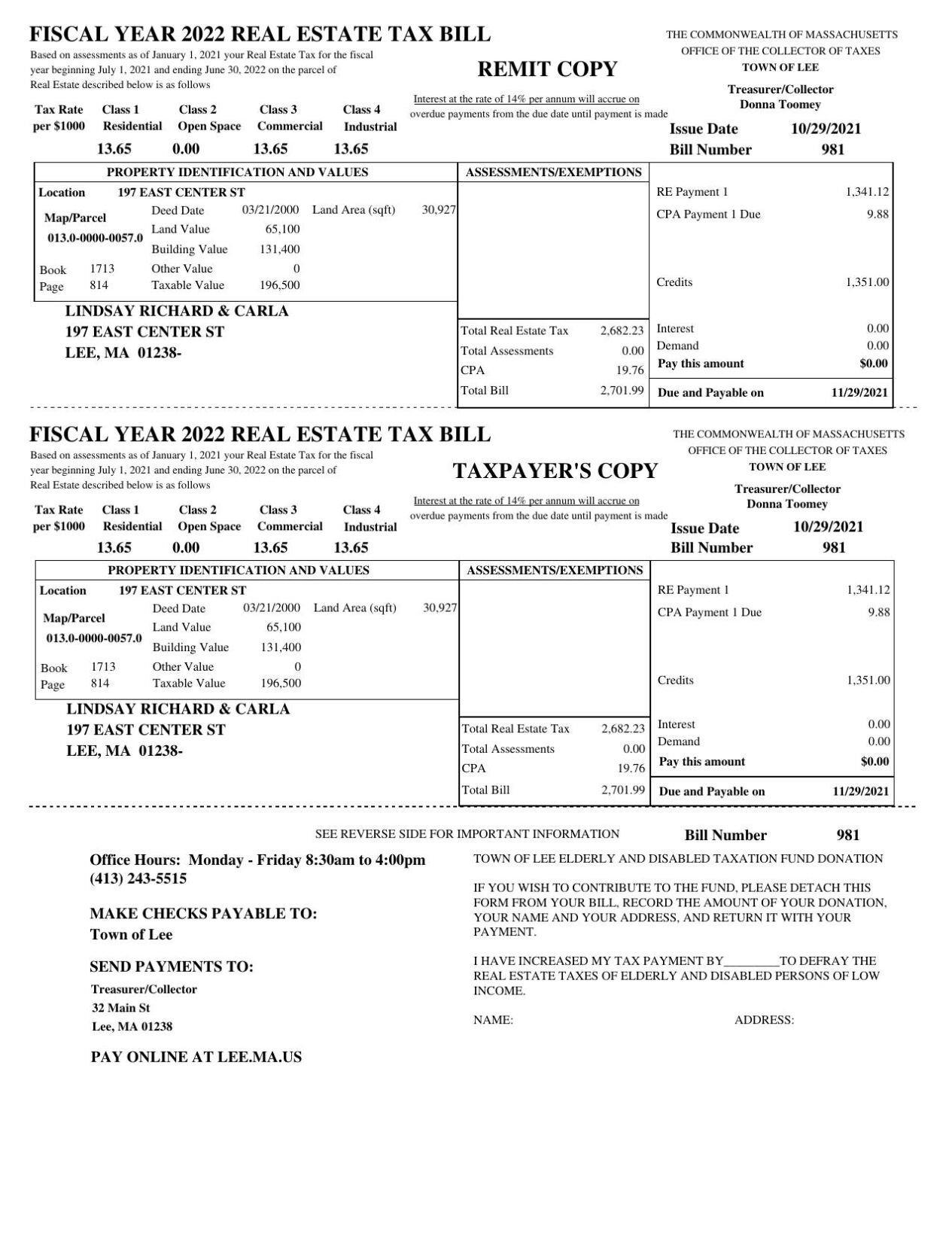

Collects all Real Estate Personal Property Motor Vehicle Excise Boat Excise Sewer Usage Septage Haulers Social Day Care and other town fees. Payment by check or money order may be mailed to the Office of the City Treasurer.

2022 Motor Vehicle Excise Tax Bill Mailed Fairhavenma

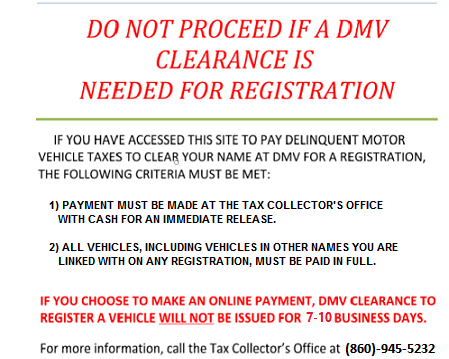

How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

. You can pay your excise tax through our online payment. MassTaxConnect Log in to file and pay taxes. TAX INQUIRES MUST EMAIL treasurersaugus-magov 781-231-4137 WATER BILLING.

FLAGGED bills will take up to 1 BUSINESS DAY to electronically clear at the RMV. The Town of Wareham is excited to offer residents an easy and convenient method to view and pay their real estate and personal. Pay andor View Bills Online or Pay by phone 508381-5455.

Payment by credit card or electronic check may be made over the phone by calling 877-675-1669. Winter and summer clothes name. Payment at this point must be made through.

They also have multiple locations you can pay including. The excise is based on information furnished on the application for registration of the motor vehicle. A collector can also.

Contact Us Your one-stop connection to DOR. You need to enter your last name and license plate number to find your bill. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

You must make payment in cash money order or cashiers check to have the mark removed immediately. Bring a lawsuit against you within 6 years of the date the excise is due and payable. Payment by check or money order may be mailed to the Office of the City Treasurer.

Go to our online system. Excise taxes are billed. WE DO NOT ACCEPT CREDITDEBIT CARDS AT ANY OF OUR WALK-IN LOCATIONS.

If you have any question that have not been. Town of Saugus Massachusetts 298 Central Street Saugus MA 01906 Phone. Please make sure to clearly indicate the bill number and property address.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Please contact the treasuercollectors office or our Deputy Collector Kelly and Ryan Associates at 508-473-9660. The owner must pay the motor vehicle excise to the city or town in which heshe resided on 01-01.

- Online Payment Processing. Deputy Collector PKS Associates Inc. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

The tax must be paid by the registered owner within 30 days of the bills issue. Please contact our Deputy Collector Point Software at 413 526-9737. You must pay the excise tax bill in full by the due date.

How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal. The Massachusetts Registry of Motor Vehicles prepares bills and distributes them to cities and towns throughout the state for collection. THIS FEE IS NON-REFUNDABLE.

A collector can also. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. When you fail to pay a motor vehicle excise a tax collector can collect the delinquent excise by placing marking your vehicle registration and operating license in non-renewal status at the Registry of Motor Vehicles RMV.

You can pay your excise tax through our online payment system. Please note all online payments will have a 45 processing fee added to your total due. Please do not mail cash.

How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal. You must make payment directly to their office. Facebook page opens in new window.

Massachusetts law sets a minimum assessment at 5 even if calculations produce a lesser amount. The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality. 9 am4 pm Monday through Friday.

2022 Federal Tax Deadlines For Your Small Business

Massachusetts Used Car Sales Tax Fees

Massachusetts Sales Tax Small Business Guide Truic

Online Bill Payment Town Of Dartmouth Ma

Massachusetts Enacts Pass Through Entity Excise Tax For 2021 Calendar Year Marcum Llp Accountants And Advisors

States With Highest And Lowest Sales Tax Rates

Gst India Tax Taxation Vat Excise Servicetax Indirecttax Economy Business Finance Law Corporate Ma Indirect Tax Goods And Service Tax Tax Credits

Town Of Watertown Tax Bills Search Pay

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Motor Vehicle Excise Tax Wellesley Ma

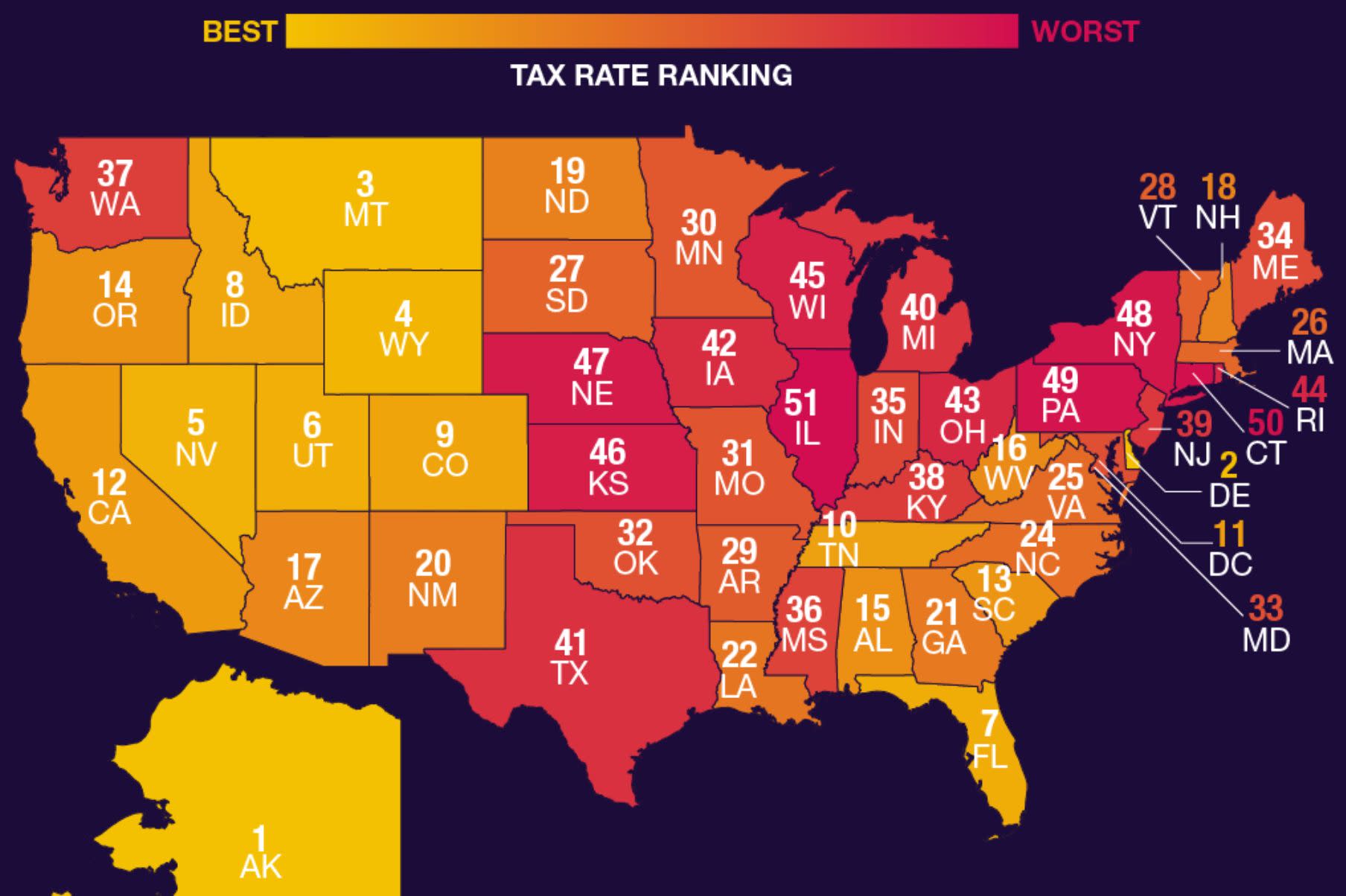

The Best And Worst U S States For Taxpayers

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

How To Register For A Sales Tax Permit Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation